Stats Can released it’s August Labour Survey results for August and it signals a challenging fall for workers, job seekers and employers alike. Canada’s job market cooled sharply in August, with the economy losing 65,500 jobs, marking the largest monthly decline since early 2022, while the unemployment rate rose to 7.1%. This is a level not seen outside of the pandemic since May 2016 according to Reuters.

“Behind every job loss are people and families, and we don’t take that lightly. Employers today are carrying the weight of economic uncertainty while trying to do right by their teams. The most effective leaders are those who acknowledge the difficulty of this moment and still find ways to invest in their people,” suggests Craig Brown, CEO Agilus Work Solutions.

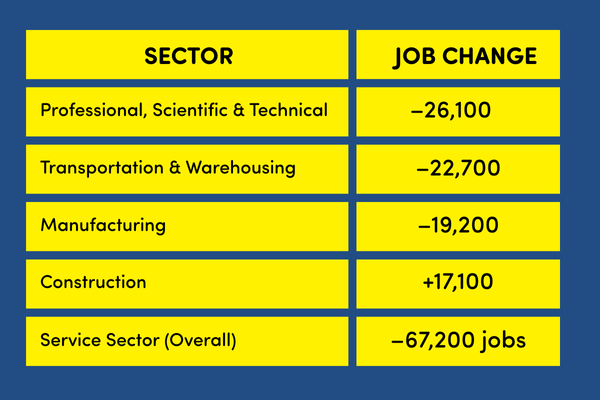

Sector Breakdown: Where Shifts Were Felt Most

The services sector took the hardest hit, particularly in professional and technical services, accounting for roughly 80% of total employment losses. Construction stood out as one of the few sectors to add jobs.

Notable regional and demographic trends emerged:

- Employment among core-aged workers (25–54) decreased notably, while youth and older workers showed more stability, suggesting that mid-career professionals are now more vulnerable to layoffs.

- Goods-producing industries posted a modest net gain of 1,700 jobs in August. This result was almost entirely due to a surge in construction (+17,100 jobs), which offset job losses in other goods-producing areas such as manufacturing and natural resources.

- While construction stood out as a bright spot, its strength was not enough to counterbalance broader declines across the service sector, where most of the 65,500 total job losses occurred.

- On the regional front, although full provincial breakdowns for August are not yet released, earlier data (July) showed sharp employment drops in Alberta and British Columbia, signaling potential areas to watch this month.

Broader Employment Indicators

Beyond the headline job and unemployment data, other key indicators also point to a softer labour market. Labour force participation slipped to 65.1%, while the employment rate declined to 60.5%, marking new lows since the onset of the pandemic.

Digging deeper:

- Employment decreases were concentrated among core-aged workers (ages 25–54), with both men and women experiencing noticeable declines. This suggests mid-career professionals are being hit hardest this month.

- Underemployment remains elevated: Nearly 8.8% of employed Canadians said they’d prefer to work more hours, up significantly from pre-pandemic levels. Part-time workers were particularly affected, with 23% experiencing underemployment compared to 6.2% among full-time workers.

- On the regional front, Ontario, British Columbia, and Alberta recorded the largest employment declines. Quebec’s figures held steadier indicating the value of province-specific strategies for employers navigating this market shift.

What This Means for Employers

In this cooling employment climate, strategy matters more than ever:

- Prioritize critical roles. Invest in positions with direct operational or revenue impact.

- Lean into internal capability. Upskilling and redeployment provide value amid hiring freezes.

- Maintain early-career pipelines. Don’t pause entry-level programs; these roles feed future talent.

- Focus recruitment where growth exists. Construction and key technical services still demand support.

- Invest in retention. Competitive wages remain a factor, with average hourly earnings across all employees up 3.2% year-over-year in August to C$36.31 (StatsCan). But retention today requires more than pay. Employers who also invest in career growth, workplace flexibility, and employee engagement will strengthen loyalty even in a cooling job market.

Agilus Perspective

At Agilus, we see employers succeed amid economic shifts by combining resilience with foresight. Effective workforce strategy includes:

- Acting with intent: Let every hire serve a strategic purpose.

- Maintaining agility: Build plans that flex with market changes.

- Nurturing relationships: Engage former candidates and employees—even when not hiring immediately.

- Aligning with data: Let real-time labour indicators guide decisions, not anecdotes.

- Attracting multi-potentials: Prioritize adaptable, lifelong learners who bring diverse skills, regardless of job title.

“The decisions employers make in moments like these define more than today’s headcount. They shape whether organizations will have the skills, trust, and culture they need when growth returns,” says Brown. “Employers who plan for the future, even in cautious ways, are already building an advantage.”

Looking Ahead

August’s figures signal a noticeable contraction. That said, they also highlight where strategic opportunities remain. Employers that invest in internal development and maintain early-career programming, and who can flex to lean into growth sectors, will be poised for recovery.

Agilus stands ready to partner with organizations across Engineering, IT, Professional Services, Light Industrial, Contact Centres, Administrative functions, Government/Public Sector, and Life Sciences. As experts in specialised talent, we deliver Canadian-made recruitment solutions that help employers plan for today and tomorrow — together.